TradingView vs MetaTrader

When it comes to trading platforms, two names often stand out: TradingView and MetaTrader. Both platforms are popular, but they cater to different needs. In this article, we will compare TradingView vs MetaTrader to help you decide which one suits your trading style.

TradingView vs MetaTrader: Overview of TradingView

TradingView is a cloud-based platform known for its charting tools. It allows traders to analyze different assets, from forex to cryptocurrencies. Its user-friendly interface makes it popular among new and experienced traders alike. With TradingView, you can access a variety of technical indicators and drawing tools, making chart analysis straightforward. You can also check out: TradingView Best Brokers list

Another advantage is its community feature. Traders can share ideas, scripts, and strategies with each other. This feature helps beginners learn from experienced traders in real time. Whether you’re following trends or customizing your indicators, TradingView offers flexibility.

The platform supports many brokers, and you can execute trades without leaving the interface. However, you may want to use the best broker for MetaTrader 4 if you prefer more sophisticated trading options.

TradingView is also known for its social networking aspect. Traders can follow each other, comment on charts, and exchange ideas. This makes it not just a trading platform but also a community hub for market participants.

TradingView vs MetaTrader: Overview of MetaTrader

MetaTrader, especially MetaTrader 4, is a widely used trading platform. It’s known for its powerful trading capabilities and expert advisors. While it might look complex at first, a MetaTrader 4 beginners course can help you get started. However, by following How To Use MetaTrader 4 Step by Step for Beginners you can easily get started on your trading journey.

MetaTrader 4 offers a more traditional approach to trading. It includes advanced features like algorithmic trading and custom indicators. Many brokers prefer MetaTrader because it integrates easily with their systems. If you’re looking for the best broker for MetaTrader 4, make sure they offer robust support and fast execution times.

The platform also supports automated trading. Traders can build or purchase expert advisors to automate their trades. This feature sets MetaTrader apart, making it ideal for traders looking to backtest strategies or implement complex trading systems. You can also check out: MetaTrader5 Best Brokers list

Moreover, MetaTrader is widely available, with most brokers offering it as a standard option. You can use it for trading forex, stocks, and commodities. It’s also more suited for desktop trading, though it has mobile versions.

User Interface Comparison

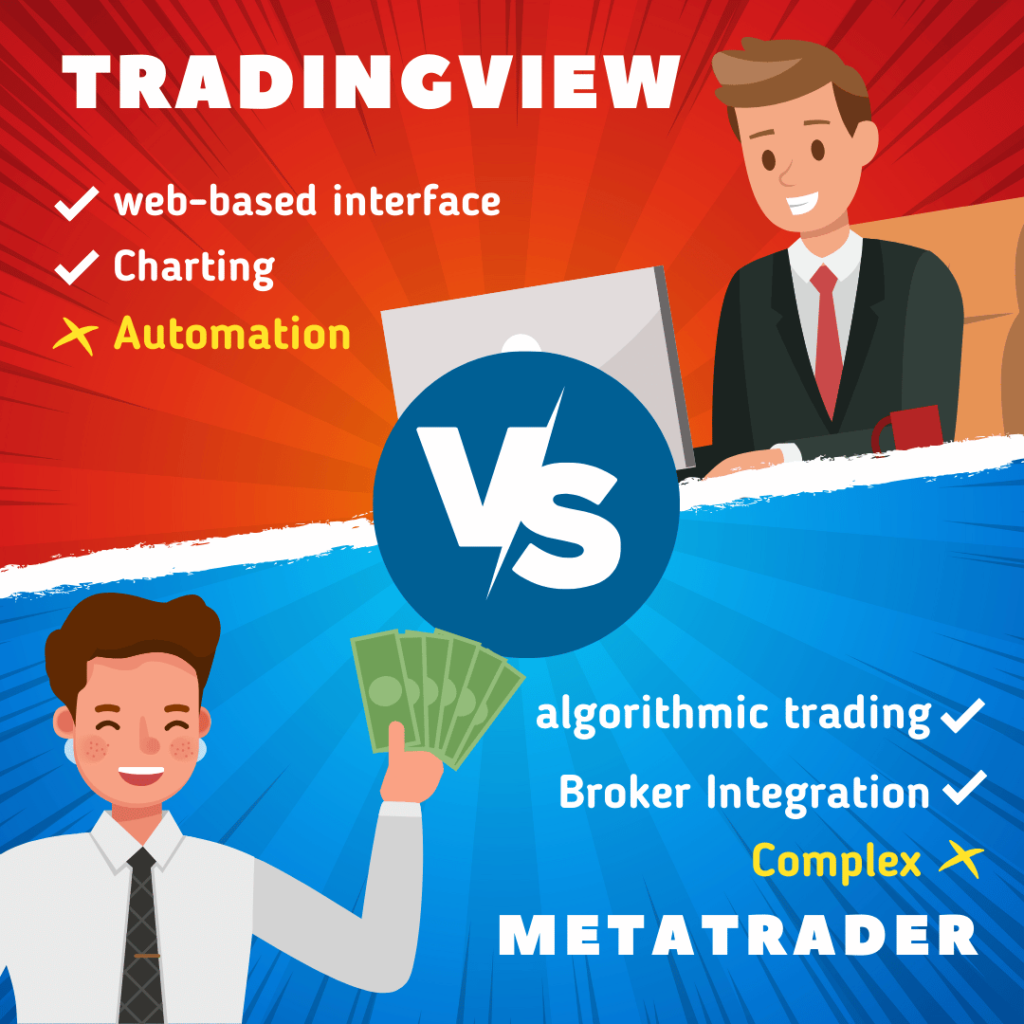

When comparing TradingView vs MetaTrader, the user interface is one of the most noticeable differences. TradingView has a modern, web-based interface that feels intuitive. Its drag-and-drop features make it easy to customize your workspace. Everything is accessible with just a few clicks, making it perfect for beginners.

On the other hand, MetaTrader’s interface can feel outdated, especially for newer traders. It has a more technical layout with menus that can seem overwhelming. However, for seasoned traders who like a more structured approach, MetaTrader’s layout offers a high level of control. You can open multiple charts, customize your workspace, and even program your own indicators.

Charting Tools

Both platforms offer excellent charting capabilities, but TradingView has the upper hand in this area. TradingView’s charts are highly customizable, offering a range of technical indicators, drawing tools, and timeframes. Its cloud-based nature ensures that your settings are saved across devices.

MetaTrader also offers good charting tools, but they are not as visually appealing as those in TradingView. However, MetaTrader compensates with its ability to execute trades directly from the charts, which can be more seamless than TradingView’s integration with external brokers.

Broker Integration and Trading Execution

One key difference between TradingView vs MetaTrader is how they integrate with brokers. TradingView supports many brokers, but it doesn’t offer as many features for live trading as MetaTrader does. You can analyze charts on TradingView and then execute trades through your broker’s platform, but MetaTrader offers a more direct experience.

MetaTrader 4 is tightly integrated with brokers, allowing for instant execution of trades. It is also known for its low-latency performance, which is crucial for high-frequency traders. If you are working with the best broker for MetaTrader 4, your trading experience will likely be seamless.

Automated Trading

MetaTrader stands out when it comes to automated trading. The platform allows you to use expert advisors (EAs) to automate your trades. This feature is especially useful for traders who want to backtest strategies before applying them in real markets. TradingView, while excellent for charting, does not offer the same level of automated trading features. However, you can integrate TradingView with third-party tools to achieve similar functionality.

Learning Curve

If you’re a beginner, TradingView may be easier to pick up. Its intuitive interface and community features make it more accessible. However, if you’re willing to take a MetaTrader 4 beginners course, you can unlock the full potential of MetaTrader. The platform has a steep learning curve, but it rewards traders with more advanced features like expert advisors and custom indicators.

Both platforms have their strengths and weaknesses. TradingView is best for traders who prioritize charting and ease of use. Its web-based nature and community aspects make it ideal for beginners and casual traders.